The cash discount program offered by Eliminate Card Fees is packed with benefits. The value is not just in eliminating your processing fees. It helps to grow your business too.

The equipment that is offered to merchants at no cost (Just do $10,000 a month in processing volume), comes packed with technology. You can expect features such as text marketing, cross-marketing, happy anniversary and birthday messages, and more. Using outdated equipment is akin to using a Motorola Flip Phone.

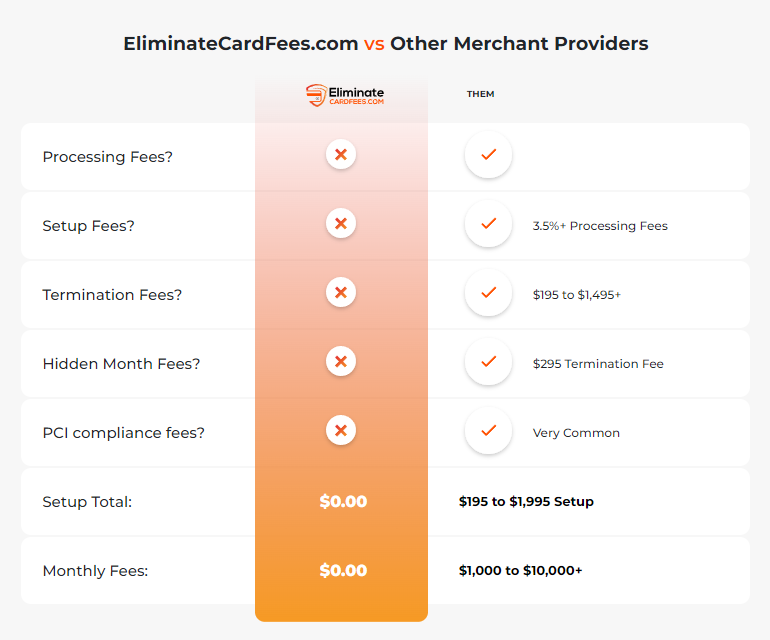

While we eliminate all of the random fees that most merchant companies add, you will also enjoy going to a 0% effective processing rate. Visa, Mastercard, American Express, & Discover must always be paid. However, our customers who implement the cash discount program or surcharge program add the cost of accepting credit cards into their pricing. It allows customers a choice to pay with cash or pay a non-cash adjusted rate. Merchant processing companies generally charge a high-risk adjustment, meaning your processing fees are generally higher due to many factors such as increase of crime in the radius of a smoke shop.

Most of the time, if you get solicited for merchant processing services you are being offered a slight reduction. Some companies that pay processing fees are on interchange plus pricing, meaning whatever the wholesale rate is, it is marked up. That is why everyone says the can save you money. However, once you make the switch to EliminateCardFees.com, you’ll enjoy a 0% merchant processing rate for good. No one can ever save you more money because you pay nothing.

You might be thinking this sounds great, but what if you don’t like it? There are no cancellation fees if you want to go back to your old way of processing. In fact, you can keep the equipment if you switch to our interchange plus solution should you want to return to paying the merchant processing fees. If you want to change providers, that’s fine too! There are no cancellation fees, just return the free equipment provided and you’re good to go.

In terms of customer experience, it couldn’t be smoother. At checkout, customers are provided with two options. A cash price. A non-cash price. If they choose a non-cash price, the rate of accepting credit cards is added to the cost. If they choose cash, they will pay the cash price.

Unlike a blanket price increase to offset the rising costs, you’re merely giving your customers an option about how they pay. If they choose to pay with a method that costs your business money, you’re just passing the exact charges you’d absorb. If they want to save a bit of money, they can pay with cash. A true win-win.